The financial world includes many types of firms, each with its own way of working. Hedge funds and prop trading firms both trade in the markets, but they do it in different ways, with different goals and levels of risk.

The financial world includes many types of firms, each with its own way of working. Hedge funds and prop trading firms both trade in the markets, but they do it in different ways, with different goals and levels of risk.

Knowing how they differ helps investors, traders, and others make smarter choices—whether they’re looking to invest, join a firm, or build a career in trading.

We’ve got you covered. Read on to find out the key differences between prop trading and hedge funds.

The financial world includes many types of firms, each with its own way of working. Hedge funds and prop trading firms both trade in the markets, but they do it in different ways, with different goals and levels of risk. Knowing how they differ helps investors, traders, and others make smarter choices—whether they’re looking to invest, join a firm, or build a career in trading.

Hedge funds are pooled investment funds that use a range of strategies to generate high returns for investors. They are typically open only to accredited or institutional investors due to their complex nature and risk level.

The term “hedge funds” is crafted of two words:

Therefore, hedge funds are entities or private pools of money that ensure the protection of your funds even in situations of market downturn.

Hedge funds work by pooling money from investors and using it to invest in different markets using distinct strategies to earn profits. The main motive of hedge funds is to generate more money in comparison to the invested money in the market.

Hedge fund managers make decisions based on market trends, data, and analysis. Profits made from successful investments are shared among investors, while the hedge funds earn money via performance fees and management fees.

Hedge funds primarily make money by using two ways:

The advantages and disadvantages of hedge funds are:

Let’s take Bridgewater Associates as an example – one of the largest and most well-known hedge funds in the world. Founded by Ray Dalio, it manages billions on behalf of institutions like pension funds and governments, using a strategy called macro investing.

This means the fund makes decisions based on global economic trends (such as interest rates, inflation, or political shifts), aiming to profit in both rising and falling markets.

As an investor, hedge funds like Bridgewater Associates give you access to professionals who manage your money using research-driven strategies. They have high entry requirements, however, and may only be available to you if you're an accredited or institutional investor.

Proprietary trading (or "prop trading") is when a firm provides its own money to traders to trade financial instruments like forex, crypto or commodities. The goal is to generate profits for the firm, rather than earning commissions from client trades.

➤ Learn more about prop trading firms.

The term “proprietary trading” is made up of two words:

Therefore, the buying and selling of trading instruments by using firms’ own money to gain profit is known as prop trading.

Prop firms provide their capital to traders, who must first pass a qualification challenge. Profits are typically split between trader and firm, while losses are absorbed by the firm. Learn more about profit splits here.

Traders make decisions on which instrument to trade and share the profit earned with the prop firm. Proprietary trading is a high-risk and high-reward approach for prop firms as they take full responsibility for the losses.

Let’s explore the top three ways mostly used by prop trading firms to earn profits in the market.

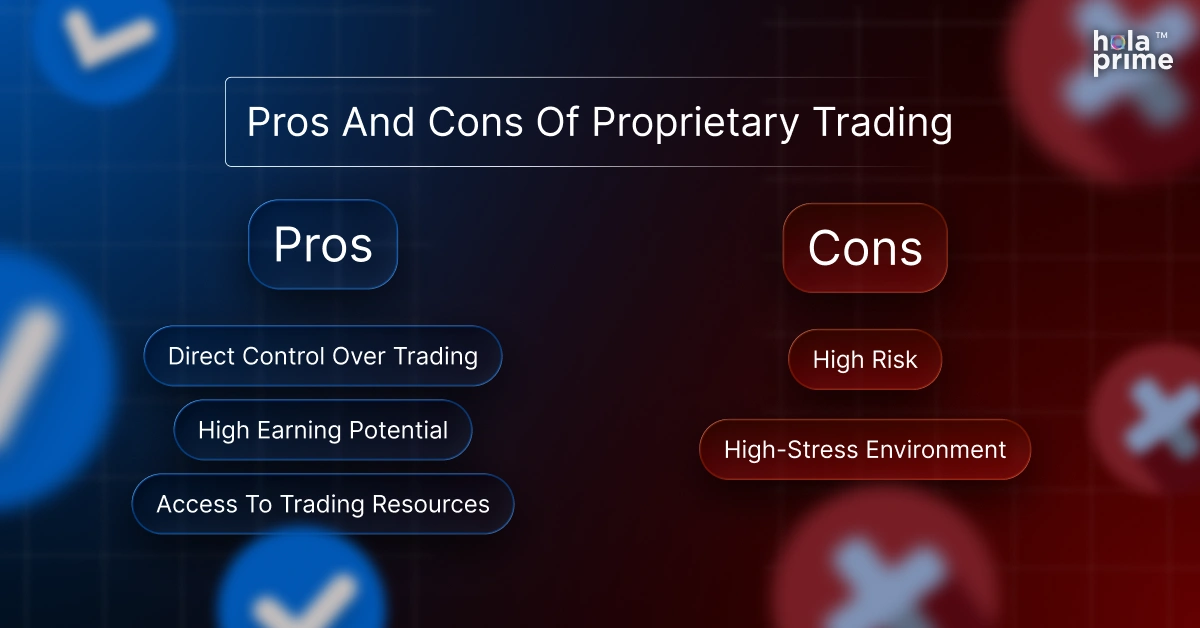

The advantages and disadvantages of proprietary trading are:

Direct Control Over Trading – Prop trading firms, companies, or institutions allow their traders to have full control to make informed decisions based on their market analysis. This is the key feature that allows them for quick adjustments to trading strategies in the market.

High Earning Potential – Prop trading has a high earning or huge profit-making potential in the market. Successful prop traders can earn substantial profits because they share gains made by them with the firms.

Access to Trading Resources – Prop trading firms provide access to trading and educational resources, which helps traders pass a prop trading challenge with ease. Therefore, aspiring traders can access educational resources like YouTube videos, trading lessons, and live sessions to get access to prop firm capital effortlessly.

High Risk – Prop trading involves significant risk as the capital of the prop trading firm is at stake. It’s always advisable for traders to manage risks carefully to avoid substantial losses because it might impact the financial health of the prop trading firm.

High-Stress Environment – Prop trading has a highly stressful environment as to perform well and gain profits, traders have to constantly monitor the market’s movements and make quick decisions in the market. You must learn to avoid emotional trading to increase the chance of success.

Now, let’s check the comparison between the hedge funds and proprietary trading:

Aspect | Hedge Funds | Proprietary Trading |

Purpose | Manage money for clients to earn profits | Provides funds and resources to traders who trade to earn a profit |

Capital Source | Money from external investors | Firm’s own capital |

Clients | Wealthy individuals, institutions | Traders who pass the evaluation |

Risk Bearing | Risks are shared between investors and the fund | Firm bears all the risks |

Fee Structure | Management and performance fees | Challenge fees |

Regulation | Subject to more regulations | Subject to fewer or no regulations |

Investment Strategies | Variety of strategies (long/short, event-driven, etc.) | Traders trade as per their own trading strategies |

Holding Period | Can hold positions for longer periods | Depends on the trader-to-trader and the firm's rules |

Transparency | Must provide performance reports to investors | No obligation to disclose performance publicly |

Goal | Generate returns for clients while managing risk | Maximize profits for the firm |

Note: Hola Prime offers a Daily Price Transparency Report to ensure fairness, reliability, and accountability among its prop traders.

Here are the core differences between hedge funds and prop trading, from the source of capital to risk and regulation:

We’ve explored the key differences between hedge funds and proprietary trading with a detailed explanation of the pros and cons of both approaches.

To summarise: Hedge funds manage capital by using various strategies, whereas proprietary trading involves firms providing their capital to traders to gain profits in the market.

Explore Hola Prime’s platforms and account types to begin your journey:

Trade with confidence with Hola Prime. We give you the tools, support and funding to execute trades successfully.

When choosing between hedge funds and proprietary trading, consider your personal goals and risk tolerance. Hedge funds offer professional management but require a lot of money to invest with less control over your funds. Proprietary trading provides direct control with high potential returns and access to a large pool of funds but also carries higher risks and pressure.

The decision to choose between hedge funds and proprietary trading should align with your investment goals and financial objectives.

Not usually. Some prop trading firms offer a base salary, but most operate on a profit-sharing basis. Traders only earn after proving profitability and passing an evaluation.

No – you won’t lose your own personal funds. However, if you breach risk rules or consistently lose, you may lose access to firm capital.

Hedge funds are regulated and have diversified strategies, which can reduce risk. However, they’re still high-risk investments and not suitable for everyone.

Choosing the right prop firm depends on your trading goals, experience level, and the type of markets you want to trade. Start by looking at the funding model. Some firms use a one-step evaluation model while others have two steps; understanding the format can help you choose a program that fits your trading style. Some firms offer instant funding, while others require you to pass a challenge first. Consider the profit split, drawdown rules, and whether they offer support like coaching, tools, or a community.

Also, know whether the firm uses a two-step challenge or a single-step - this affects how quickly you can get funded and how much proof of consistency you need to provide.

Become an Hola Prime Trader

Start trading within minutes!

Start Now Join DiscordDisclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

Sam Saleh, a London-based trader, began his trading journey at 19 while studying Business at the University of Bedfordshire. With expertise in trading and a background in marketing, he now coaches at Hola Prime, where he develops educational content aimed at building trader confidence, consistency, and financial literacy.

All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.

ISO 9001:2015

Quality Management System - QMS

ISO 22301:2019

Business Continuity

Management System - BCMS

ISO/IEC 27001:2022

Information Security

Management System - ISMS

About: Simulated trading operations are managed by Hola Prime Limited, a company registered at L1, Shaw House, 201 Wan Po Road, Tseung Kwan O, Hong Kong.

Holaprime Limited a company registered in Cyprus having registration number HE 454359 is a 100% subsidiary of Holaprime Limited Hong Kong.

For MT4 And MT5: Hola Prime Limited, with Company registration number 220248, and registered office at 4th Floor, Docks 4, The Docks, Caudan, Port Louis, Mauritius, is authorized and regulated by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer (Full Service Dealer, excluding underwriting) under license number GB24203729.

For DXTrade, cTrader and MatchTrader: Gooey Trade, GT Tech LLC 6800 Broken Sound Parkway Northwest Suite 150 Boca Raton, FL 33487 US

RISK DISCLOSURE:

All of the information provided on this website and by Hola Prime Ltd, or its affiliates, is intended solely for Educational purposes. Nothing on this website is to be construed as investment advice, nor an offer or invitation to buy or sell any financial instrument, nor does it endorse, recommend, or sponsor any financial product, company, or fund. Testimonials on the Company’s website may not be reflective of the experience of other clients or customers and should not be considered as an assurance of future performance or success. Hola Prime only provides services of simulated trading and educational tools for skill assessment and enhancement of traders. Hola Prime does not act as a broker and does not accept any deposits. Any purchases made should not be regarded as deposits. There are no promises of rewards or returns. Trading in financial markets is inherently high-risk and speculative. The content and information provided on this website are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

HYPOTHETICAL PERFORMANCE DISCLOSURE:

ACFTC Rule 4.4-Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses is material points, which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect trading results. Testimonials appearing on this website may not be representative of other clients or customers and are not a guarantee of future performance or success.

EVALUATION DISCLOSURE:

The customer pass rate of the Challenge/Evaluation program was 35% between 10th November, 2024 – 29th May, 2025, who traded at least one evaluation and obtained a Hola Prime Account during this time period. The Challenge and Hola Prime Accounts are meant to be a realistic simulation of trading under actual market conditions, including commissions, to mimic real market conditions, as much as possible. The evaluation is difficult to pass even for experienced traders. The Evaluation is not suggested for individuals with little to no trading experience.

CUSTOMER COMPENSATION DISCLOSURE:

All trades presented for compensation to customers should be considered hypothetical and should not be expected to be replicated in a live trading account. Hola Prime Accounts may represent simulated accounts or live or copied accounts. Hola Prime does not provide services to the residents of certain countries including – Afghanistan, Belarus, Burundi, China, Cuba, Congo, Sudan, Sri Lanka, North Korea (Democratic People’s Republic of Korea) and Yemen.

This is the only website for Hola Prime. We are not using any third party websites or links. Any link, outside of this website that claims to be ours, could be fraudulent and users are advised to not use it.

© 2026 Hola Prime All rights reserved.