The doors have started to crack open. And guess who’s walking through? Every day, traders. People like you - curious, hungry to learn, willing to take risks, and looking for more than just a regular 9-to-5. That’s where futures prop trading comes in.

For beginners, getting started with a futures prop firm typically means choosing an evaluation program and practicing strict risk management from day one.

If you’re impatient to trade live capital, an instant funding prop firm might sound tempting - but be sure you’re truly ready, since skipping the evaluation means there’s no trial run for your strategy.

But what exactly is it? And why is everyone suddenly talking about it?

What Is Futures Prop Trading?

At its core, futures prop trading is about trading futures contracts using someone else’s money - usually a firm’s - while keeping a share of the profits. Sounds like a dream, right? But it’s not some get-rich-quick scheme. It’s a partnership. You bring the skill, the strategy, the discipline. The firm brings the capital, the tools, and often the mentorship.

Now, what are futures contracts? Let’s understand this through an example. Suppose you agree to buy or sell something (like oil, gold, or even the S&P 500 index) at a specific price, at a specific time in the future. These are highly standardized contracts traded on exchanges like CME. Unlike buying stock, you’re not investing in a company’s future - you’re speculating on market moves and the price difference.

And the “prop” in prop trading? That stands for “proprietary.” You're not managing clients’ money like a traditional fund manager. You’re trading with the firm’s own funds, and they’re betting on you to make them (and yourself) a profit.

So, if you’ve got the skills - or the potential to develop them - you don’t need to be rich to trade big. That’s a massive shift in the landscape, isn’t it?

Why Trade Futures?

Why not trade stocks or crypto, or forex instead? Fair question.

Futures markets are different beasts. They’re fast, deep, and global. Contracts like the ES (S&P 500 E-mini), NQ (Nasdaq 100), CL (Crude Oil), and GC (Gold) see massive volumes daily. That means more liquidity, tighter spreads, and cleaner price action - exactly the kind of environment prop firms and serious traders thrive in.

Plus, futures offer built-in leverage. You can control a large position with a relatively small amount of capital. Scary? It can be. But in the hands of a trained trader, it’s like giving a skilled chef a sharp knife - it just works better.

And let’s not forget transparency. Futures are traded on regulated exchanges. The data is clean. The order book is public. Unlike forex or crypto, where data can be manipulated behind the scenes, futures trading is... well, fairer.

What Are Futures Trading Prop Firms? Why Do They Fund?

Futures trading prop firms aren't just looking to throw money at random traders. They’re building teams. Think of them like talent scouts in sports - watching for raw potential, coachability, and hunger. They want traders who can handle pressure, follow risk management rules, and think strategically.

Most of these firms don’t just hand you money right away. They test you first, usually through what's called a challenge or evaluation phase. You trade in a simulated environment using real market data. If you meet their targets (without blowing up your account), you "pass" and get access to a simulated funded account. And after that, you might get a live account.

It’s performance-based. Fair. Transparent. Meritocratic.

And the best part? If you lose, you don’t lose your own money. The worst that happens is you go back to the drawing board, maybe take the challenge again, learn, and grow.

Isn’t that a much smarter way to learn to trade?

The Trader’s Mindset: It’s Not Just About Charts and Strategies

Let’s pause for a moment.

Everyone talks about strategies, indicators, market structure... but here’s the truth: trading is mostly a psychological game. Especially in futures, where leverage amplifies not just your profits, but your fears, doubts, and impulsive mistakes.

Ever taken a trade, only to close it two seconds later in panic, then watched it go in your direction? Or doubled down on a loss, hoping it’ll turn around? Yeah. That’s the part of trading no one prepares you for - the war between logic and emotion.

Prop firms know this. That’s why the best ones don’t just give you capital - they guide you. They set rules not to limit you, but to protect you from yourself. Think daily loss limits, maximum drawdowns, position sizing... these aren’t shackles. They’re a framework for staying sane in a game that can drive you mad.

So, if you’re thinking about entering futures prop trading, ask yourself: Can I follow rules? Can I stay calm when things get volatile? Can I handle winning and losing without losing my mind?

If yes - or even if maybe - keep reading.

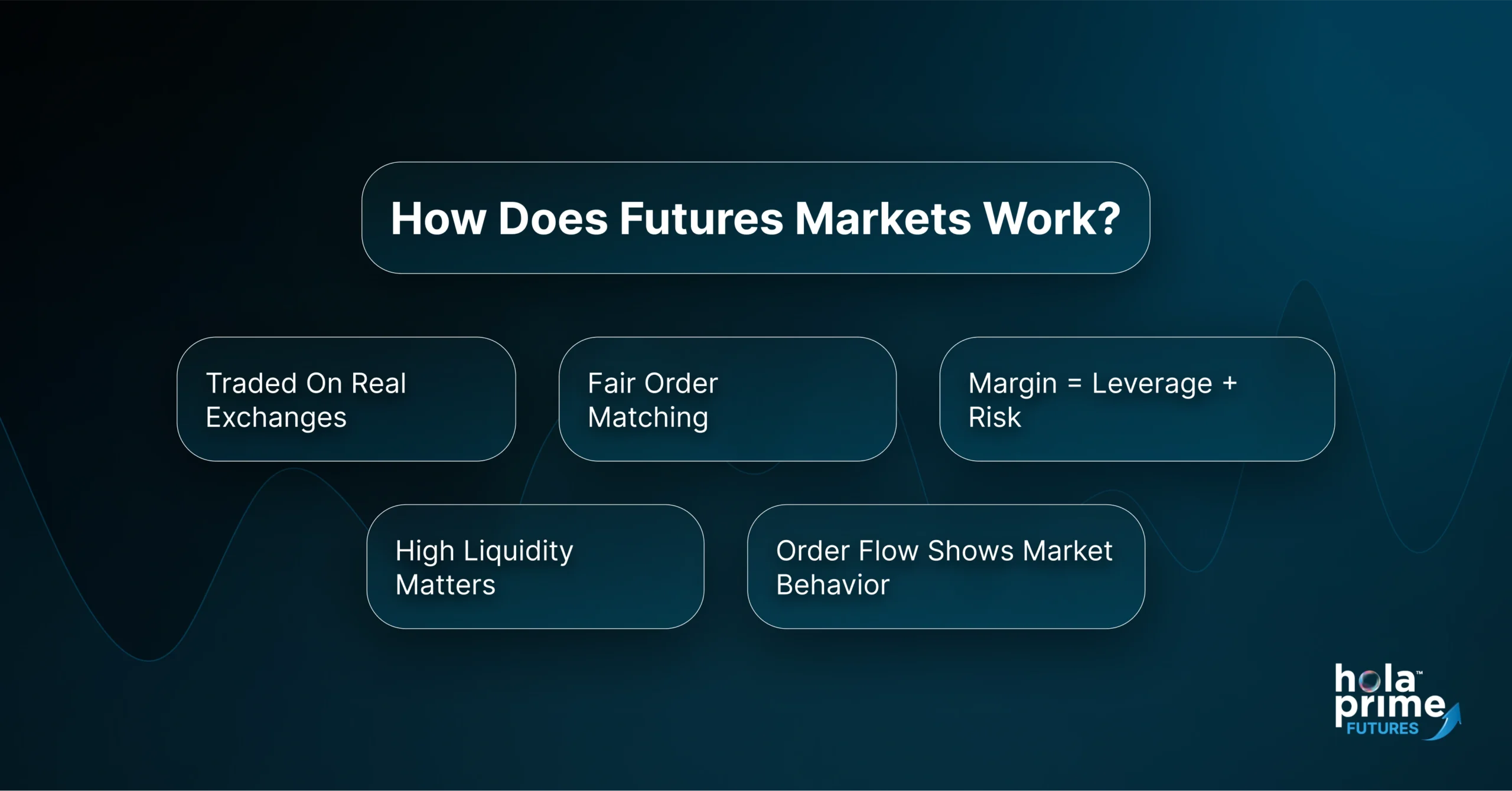

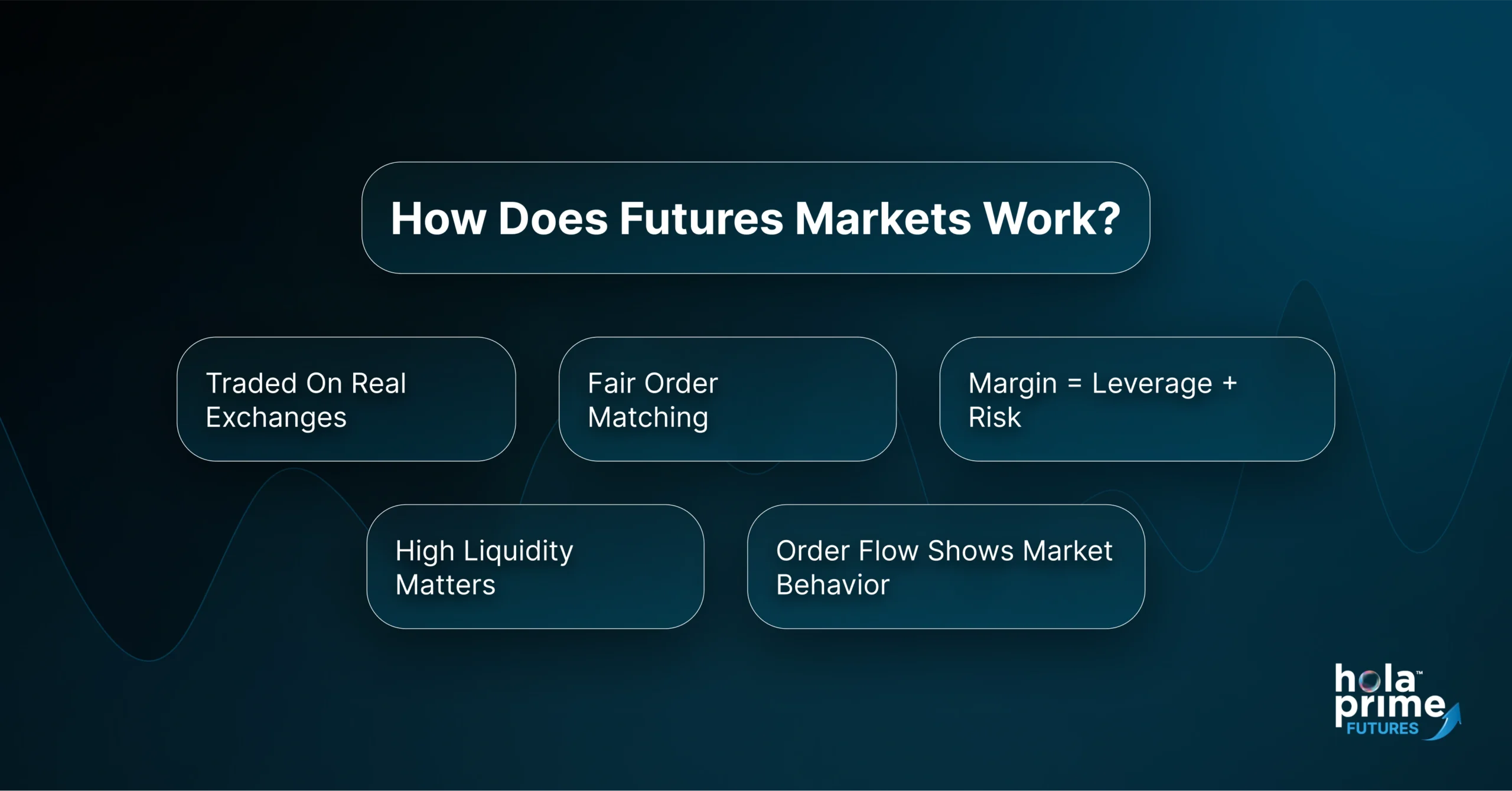

How Does Futures Markets Work?

So now that we’ve peeled back the curtain on what futures prop trading is… let’s talk about the where and how.

When you trade futures, you're not trading in some back-alley peer-to-peer setup. You're plugged into real, regulated exchanges like the CME (Chicago Mercantile Exchange). These are institutions that set the rules, standardize the contracts, and match your orders with others in real time.

Why does that matter? Because it creates a level playing field. You’re not trading against your broker. You’re not wondering if your order got filled. The infrastructure is built to be fast, transparent, and fair.

Here’s something else you might be wondering: “If I’m trading with a prop firm’s money, how does margin work?”

Great question. Margin in futures is a double-edged sword. It allows you to control large positions with a small capital outlay - but it also amplifies every tiny move in the market. That’s why prop firms are obsessed with risk control. They want you to use those funds like a scalpel, not a sledgehammer.

Then there’s liquidity, another word you’ll hear tossed around a lot. What it really means is this: can you get in and out of a trade fast, without the price slipping? High-liquidity markets like ES or CL let you do just that. That’s why most prop traders flock to them - because when your strategy depends on tight entries and exits, liquidity is your best friend.

And let’s not forget order flow - the way buy and sell orders stack up in the market. Ever watched the depth-of-market (DOM) window and seen how orders pile in around certain levels? That’s the kind of detail prop traders study relentlessly. They learn to read market sentiment in real time, not just from candlesticks but from the actual behavior of other traders.

Inside the Mind of a Prop Trader: It’s More Than Just Technical Analysis

You can memorize every technical pattern, master five trading strategies, and backtest until your eyes hurt… but if you don’t have the right mindset, it’s all just numbers on a screen.

So what makes a real prop trader different?

First, they understand probability. They don’t aim to win every trade - because they know that’s impossible. They aim to be consistent over time. One loss doesn’t shake them. Ten losses don’t break them. They zoom out and look at the bigger picture: Am I executing well? Am I managing risk? Am I improving?

Second, they’re emotionally agile. Sounds strange, doesn’t it? But think about it. Every trade tests your patience, your ego, and your fear of missing out. A skilled futures prop trader knows when to press and when to pull back. They don’t chase. They don’t revenge trade. They wait. They trust their plan.

And third, perhaps most importantly, they know how to reflect. Journaling isn’t some optional side hobby. It’s a lifeline. Every good trader I’ve met keeps notes: why they entered, what they saw, how they felt, what they’d do differently. That’s how growth happens.

So ask yourself: are you just looking to “win trades”? Or are you trying to become a real trader? Because that difference is everything.

How Prop Traders Actually Make Money in Futures

Now, let’s talk about the meat and potatoes of it all - strategy.

Futures prop trading isn’t about guessing. It’s about edge - a repeatable, testable advantage that plays out over dozens or hundreds of trades.

Some traders go after momentum - those fast moves after big news or volume spikes. If you’ve got quick reflexes and a sharp eye, this might be your game. It’s about catching breakouts early, riding them just long enough, and getting out before the pullback.

Others prefer mean reversion - waiting for the price to overextend and then betting it will snap back. It’s a more patient, contrarian approach. You’re the one fading those emotional moves, like a poker player calling someone’s bluff.

There’s also the world of volume profile and order flow, where traders study how price interacts with high-volume nodes, low-volume zones, and key liquidity levels. This is deeper, more analytical trading. You’re not just reacting - you’re anticipating, based on how the market is behaving in real time.

And then… there’s spread trading. This is more niche, but incredibly powerful. You buy one futures contract and sell another related one - say, long crude oil and short Brent. The profit comes from the difference between them widening or narrowing. Low risk, low margin, high scalability.

Every strategy comes down to personality. Are you aggressive or patient? Do you like fast trades or longer setups? Do you thrive in volatility or stability?

The secret? Don’t chase every strategy. Pick one that fits you, master it, and let it evolve with time.

Tools Every Futures Prop Trader Needs

Ever tried building a house with your bare hands? You can’t. You need tools. The same goes for trading.

At a basic level, you’ll need a solid platform. Most prop firms provide platforms like Rithmic- RTrader Pro, Quantower, ProjectX, or their own proprietary dashboards. These tools aren’t just fancy interfaces - they’re your command center. They let you execute, manage risk, and analyze data with speed and precision.

Then there’s data feeds. For futures, milliseconds matter. Whether you’re looking at Level II data, real-time volume, or DOM (Depth of Market), you need a feed that’s fast, accurate, and clean. Most good firms provide it, like Hola Prime provides Rithmic Data feed, which is compatible with platforms like Atas, Tickblaze, etc, but always ask what you’re getting.

You’ll also want risk dashboards. These show you things like your drawdown, daily loss, open trades, and margin usage in real time. They’re not just for the firm’s peace of mind - they help you stay accountable.

And of course, the goldmine: backtesting software. Various platforms offer replay mode, or even custom Excel models that can help you test your strategy over years of data. That’s where your confidence comes from. You’re not hoping a setup will work. You’ve seen it work. You’ve lived it - on paper at least.

In short, great tools don’t make a great trader. But they sure help sharpen one.

Inside a Futures Prop Trading Firm: What’s Really Happening Behind Those Screens?

Okay, so by now, you're probably thinking, “Alright, I get the trading part. But how does the firm itself actually work? What’s in it for them?”

And honestly, it’s a smart question. Because understanding the business model of a futures prop firm helps you see the bigger picture - where you fit in, what they expect from you, and why they’re willing to take a chance on someone who might be trading from a spare bedroom in London or Los Angeles.

Well, prop firms aren’t some mysterious institutions run by billionaires tossing cash around. They’re highly structured businesses built around one simple idea - scaling trading performance without taking risk.

When they fund a trader, they’re not gambling. They’re investing. And just like any investor, they do their due diligence. They test you, measure your performance, watch your risk profile, and only then do they put you on a simulated funded account or live account. That process? It protects both of you.

Most futures prop firms operate on a profit-sharing model. Say you generate $10,000 in net profits in a month. Depending on the firm, you might keep 70% to 90% of that, while they take the rest. You don’t need to bring any capital upfront, just an evaluation fee, which can be one time or monthly (which usually covers data and platform access). There’s no loan. No debt. Just performance-based progression.

What really sets them apart, though, is their emphasis on structure and accountability. You’re not just “going rogue” on your own capital. You’re operating within defined parameters - daily drawdowns, max loss limits, and position sizing rules. Some traders find this restrictive at first. But over time? They realize it’s the guardrail they didn’t know they needed. Some firms like Hola Prime Futures have removed the daily loss limit rule to provide a little flexibility to traders.

And let’s not forget the mentorship and trading community aspect. The better prop firms pair you with a coach or offer community spaces where experienced traders can share setups, mindset shifts, and even losses. Because, believe it or not, trading can be lonely, and knowing there’s a crew behind you changes everything.

So if you thought getting that simulated funded account was just about proving your strategy, think again. It’s about proving your reliability, your discipline, and your potential to grow into something bigger.

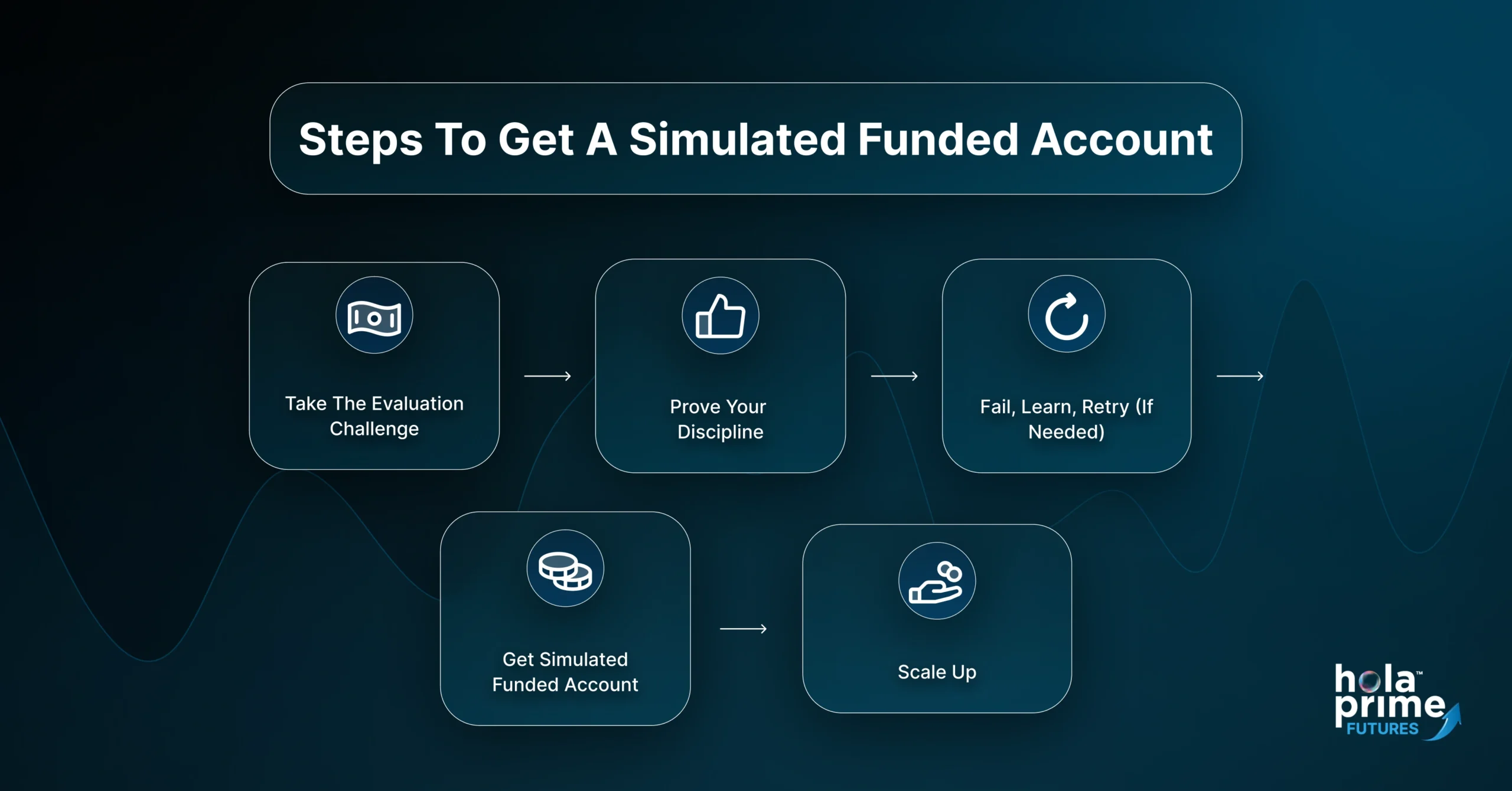

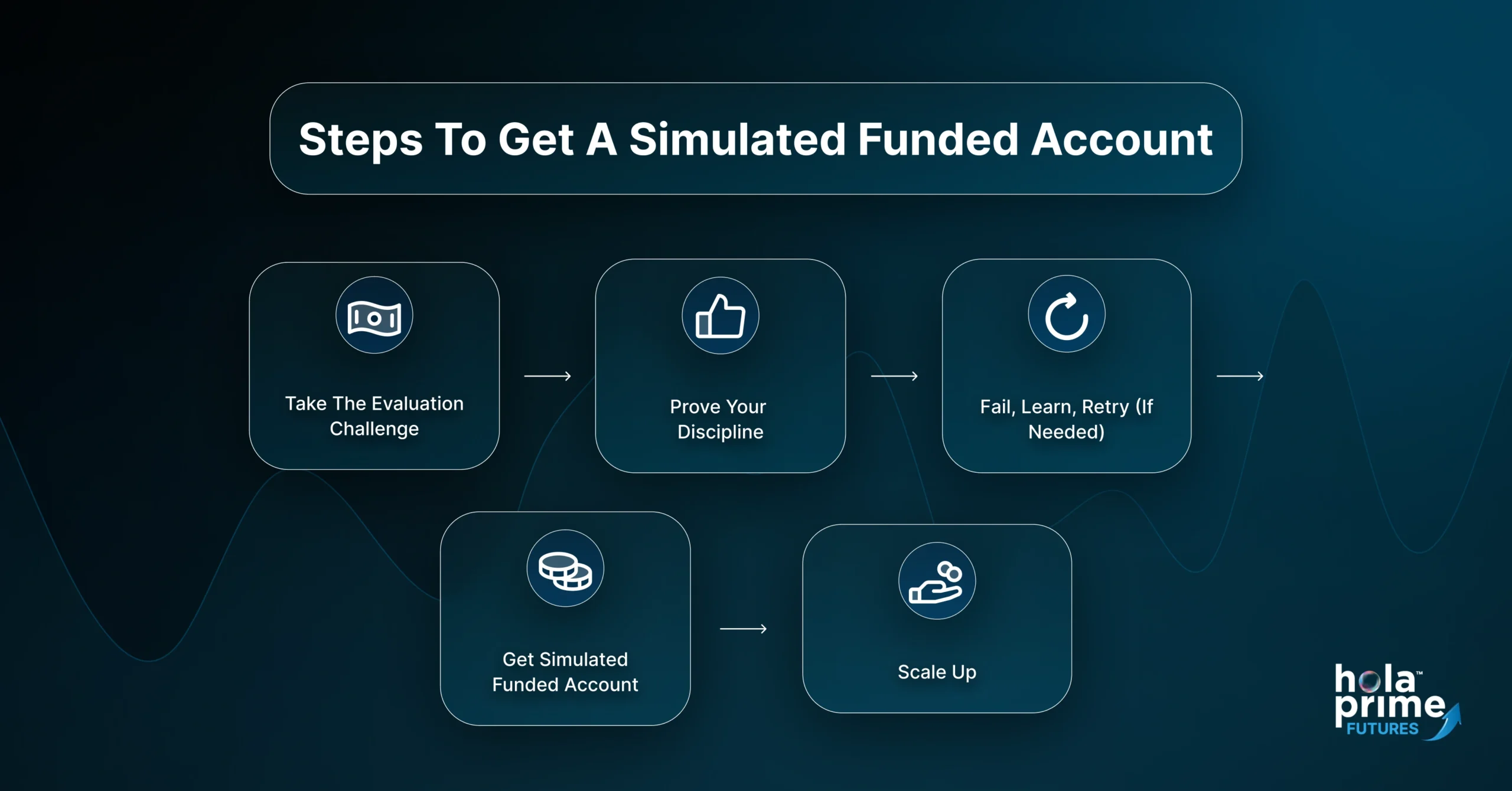

How to Get the simulated Funded account: The Road from Evaluation to Live Account

So now you’re fired up. You’re thinking, “I’ve got what it takes. How do I actually get into one of these prop firms?”

Let’s break it down. It usually starts with a challenge or evaluation phase. This isn’t live trading with real money (yet), but it’s very real in terms of expectations. You’ll be given a simulated account - say $50,000 or $100,000 - with specific rules: hit a profit target, stay within your drawdown limits, follow the max daily loss or overall loss rule, and avoid breaking any consistency requirements.

Sounds simple? On paper, sure. But in practice, it’s a deep psychological test. The challenge isn’t just testing your trading edge - it’s testing your behavior under pressure. Can you take a string of losses without going full revenge mode? Can you walk away for the day if you hit your daily stop?

Most traders fail on their first few attempts. And that’s okay. Because each failure teaches you something you can’t learn from a YouTube video: how you react when it’s your performance on the line.

Once you pass, you’re usually moved to a simulated funded account - a second stage of simulation where payouts are based on performance. Yes, you actually get paid. Most firms offer monthly or even weekly payouts, with some now doing 1-hour withdrawals like Hola Prime Futures. After this, some firms test your skills and can even provide you with a live account.

But let’s address something a lot of traders hesitate to ask: “Is this real? Can I really make money this way?”

Yes. But it’s not magic. It takes skill, time, and emotional maturity. And even then, consistency doesn’t come overnight. Some traders earn a small amount at first $500, $1,000. Others scale up to 5 figures a month. But every single one of them started with the same thing: a clear, defined process and the humility to stick to it.

How Futures Prop Trading Stacks Up Against Other Prop Paths

Let’s say you’ve been exploring other types of trading too - maybe forex, or even crypto. Naturally, you're wondering: how does futures prop trading compare?

Let’s be honest - each market has its flavor.

Forex prop trading is huge, especially with firms offering instant funding or low-barrier evaluations. The upside? Lower volatility, 24/5 trading. The downside? The market can be murky. It’s decentralized, meaning spreads vary, liquidity can vanish, and manipulation is not unheard of. Plus, there’s often less regulation.

Futures, on the other hand, hit a sweet spot.

They’re regulated. Transparent. Liquid. You’re trading real products tied to real macroeconomics - indices, oil, gold, interest rates. There’s movement, which means opportunity. And because of the leverage, you don’t need giant account balances to generate meaningful returns.

Plus, futures markets are institutional-grade. You're competing in the same space as professional hedge funds and banks, not retail influencers and pump-and-dump Discord groups. That means cleaner price action and less noise.

So is one “better” than the other? Not necessarily. But if you want a structured, transparent, globally respected trading path, futures prop trading is hard to beat.

Risk Management in Futures Prop Trading: Your Shield in a Ruthless Game

Let’s get something straight - futures trading can be brutal. Glorious when you’re right, but absolutely unforgiving when you’re wrong. Ever watched a position move against you so fast that you’re frozen at your screen? Happens to the best of us.

That’s why risk management isn’t some optional feature - it’s the core of the game.

And if you’re working with a prop firm, they’ll drill that into you fast. You’ll hear terms like max daily loss, maximum drawdown, trailing drawdown, risk-to-reward, and position sizing until they’re etched into your brain. Not because they want to limit your potential, but because they know something most retail traders learn too late - survival comes before success.

So, how do they manage risk?

Let’s start with daily loss limits. These are set caps on how much you’re allowed to lose in a single day. Hit that limit? You’re out until tomorrow. Sounds harsh? Maybe. But in reality, it’s a life raft. It forces you to stop digging when you’re in a hole. With Hola Prime Futures you don’t need to worry about the losses you make in a day, as there is no daily loss limit.

Then there’s maximum drawdown - the total loss you're allowed to take from your starting balance before your account gets disabled. Think of it as a fence. Stay inside it, and you’re safe. Cross it, and you’re done.

And yes, this also means managing position size like a professional. No doubling down. No “YOLO” contracts because you feel confident. Prop traders use calculated risk per trade, typically between 0.5% to 1% of the account value. Not because it’s trendy, but because it’s sustainable.

Ever heard the phrase, “Live to trade another day”? That’s the trader’s golden rule. Protect your downside, and the upside will take care of itself.

What Moves the Markets: Macro Events Every Futures Trader Should Watch

Ever opened a position that looked perfect on the chart, only to get stopped out in five seconds flat?

Then you find out… the Fed just announced a surprise interest rate hike.

This is the kind of moment that humbles even the most experienced trader. Because no matter how sharp your setup is, if you’re blind to macro events, you’re trading half the market.

In futures, macro data is king. Economic releases move the markets violently, sometimes beautifully, but always decisively.

Take Non-Farm Payrolls (NFP) for example. On the first Friday of every month, this jobs report comes out, and that may impact the ES (S&P 500 futures). If you’re not aware, you're toast. But if you are? And you’re patient? That volatility becomes pure opportunity.

The same goes for CPI (Consumer Price Index) - inflation numbers that shape Fed policy. If inflation runs hot, you might see bond yields spike, gold drop, or indices sell off. That’s not just news - it’s trade fuel.

Then there are FOMC meetings, where the Fed announces interest rate decisions. These are like thunderclaps. Futures traders hang onto every word in Jerome Powell’s press conferences, trying to decipher what’s really being said between the lines.

Want to go even deeper? Watch global patterns. How is China’s economy performing? What’s happening with oil inventories? Is there tension in the Middle East that could affect crude futures?

This is what separates technical traders from informed traders. The ones who understand why the price is moving, not just how it’s moving.

Because when you align your trades with the macro context? You’re not swimming against the current - you’re riding the tide.

How to Build a Personal Trading System That Actually Works

Now let’s talk about the holy grail - not some magical strategy, but something even better: a system that fits you.

Here’s the truth most trading courses won’t tell you: a profitable system isn’t something you find. It’s something you build.

And building one starts with knowing yourself.

Are you a morning person? Then maybe the New York Open is your time to shine. Hate sitting at the screen for hours? Maybe you’re a one-trade-and-done type. Do you love analyzing charts for patterns? Then you might thrive in a technical strategy. More instinctual and reactive? Order flow could be your edge.

It starts by choosing a core setup. Maybe you favor breakouts. Maybe you love bouncing off support. The key is picking one and testing it obsessively. That means backtesting, forward testing, and live testing. Tweak. Adjust. Measure.

And once you find something that starts to work… lock it in with rules. Entry conditions. Exit plans. Risk size. Maximum trades per day. It sounds rigid, but trust me - it gives you freedom. Freedom from second-guessing. Freedom from chaos.

Then comes the most underappreciated tool in trading: your journal. Every trade you take should be recorded. Screenshot. Entry reason. Emotional state. Result. What do you do better? Over time, patterns emerge - not just in the market, but in you.

Your system becomes a mirror. It reflects your strengths. Your flaws. Your growth.

And that’s when the magic starts to happen. You stop reacting to the market and start responding with intention.

The Real Educational Path for Futures Prop Traders

Let’s be honest - trading can feel overwhelming when you’re starting out. The jargon. The platforms. The pressure. It’s easy to get lost in a sea of YouTube videos, free Discord servers, or Twitter threads that promise riches but deliver little clarity.

So, where should you actually learn?

First, let’s get this out of the way: there’s no secret course that guarantees success. And if someone’s selling you one, be skeptical. What you need instead is a mix of real-world practice, structured learning, and ongoing mentorship.

Many futures prop firms today offer in-house education platforms. Hola Prime Futures, for instance, has its one-to-one coaching, educational material, and live trading breakdowns by veteran traders. This isn't fluff. It's battle-tested material that actually prepares you for the challenges you’ll face.

Learn how futures move. Test how the DOM reacts at key levels. Observe how macro events impact different contracts.

And please - don’t skip journaling. It’s your personal mentor in disguise. If you review just one trade a day with brutal honesty, in a year, you’ll have more insight than most retail traders ever gather.

As for mentors? Don’t look for saviors. Look for systems thinkers. People who teach you how to think, not what to copy. That’s what real trading education looks like.

Remember, this path isn’t just about mastering a strategy. It’s about becoming a better decision-maker, a more grounded thinker, and eventually, a self-led professional.

The Future of Futures Prop Trading: Where’s This All Headed?

So you’re getting the hang of it. You understand the system, the mindset, and the strategies. But here’s a question worth asking: Where is futures prop trading going from here?

The truth is, we’re entering a golden age.

The old gatekeepers - banks, hedge funds, physical trading floors - are still in place, but the prop firms that run lean, think global, and scale fast. You could be a trader in Cape Town or Toronto and still access the exact same markets and tools as someone in New York.

Remote prop trading desks are booming. Some firms now operate fully online, with global teams working across time zones. The evaluation, funding, and payout processes are automated. Everything is faster, cleaner, and more transparent.

But perhaps the biggest shift is inclusion. The image of a trader as a 40-something guy in a suit screaming on the phone? Dead. Futures prop trading today is being led by 20-somethings in hoodies, women breaking into trading rooms, and career switchers who decided it’s never too late to learn.

Even the asset classes are evolving. Crypto-futures, carbon credits, and volatility indices are becoming more popular. The old “one-size-fits-all” model is gone. Now, you can build your edge in a niche that fits your interests and strengths.

Final Thoughts: Is Futures Prop Trading Worth It?

You started reading this with curiosity. Maybe even doubt. Futures prop trading sounded like something reserved for math geniuses or Wall Street insiders. But now? Hopefully, it feels a little more real. A little more possible.

You don’t need a finance degree. You don’t need a six-figure bank account. What you do need is commitment. The willingness to show up, take losses, learn fast, and stay grounded when things get hard.

Because let’s not sugarcoat it - this will be hard. You’ll have bad days. You’ll get frustrated. You’ll question if it’s even worth it.

But then you’ll have those days where everything clicks. You’ll call the move before it happens. You’ll manage your risk like a pro. You’ll finish the day green, not just in profit, but in growth. And you’ll remember why you started this journey in the first place.

Futures prop trading is not just a career. It’s a craft. A discipline. A constant conversation with the markets - and with yourself.

So if you're still here, still reading, still hungry?

Then maybe you’re ready.

Frequently Asked Questions

1. What Is Futures Prop Trading?

Futures prop trading is a unique opportunity for skilled traders to trade in the futures market using capital provided by a firm, also known as a futures trading prop firm. Instead of using your own money, you leverage the firm’s funds, and in return, share a percentage of the profits.

2. How do I qualify for a simulated funded account?

You typically need to pass a challenge or evaluation phase by meeting profit targets and staying within risk parameters in a simulated environment.

3.Are futures trading prop firms legit?

Yes, reputable firms operate transparently and offer structured programs. Always check reviews, payout history, and their risk rules.

4. What makes futures different from forex or crypto?

Futures are traded on regulated exchanges, are highly liquid, and offer standardized contracts. This makes them fairer and more predictable.

5. What instruments can I trade in futures prop trading?

Popular instruments include the S&P 500 E-mini (ES), Nasdaq (NQ), crude oil (CL), gold (GC), and Soybean Oil (ZL).

6. How much can I make in futures prop trading?

It depends on your consistency, strategy, and risk control. Profits can range from a few hundred dollars to five figures monthly.

7. Do I need to bring my own capital?

No. You only pay a one-time or monthly fee for the challenge. The firm provides the trading capital upon successful completion of the challenge.

8. What risks are involved?

While you don’t risk personal capital, failing to follow risk rules can disqualify you.

9. Can beginners join futures prop trading?

Yes, but beginners should first gain some experience through mentorship and study. Many firms also offer coaching and resources.

10. Which is the best futures trading prop firm?

Look for firms offering fair rules, fast payouts, solid support, and a good community. Hola Prime Futures is one top options with 1-hour withdrawals and strong trader support.

Become an Hola Prime Trader

Start trading within minutes!

Start Now

Join Discord

Disclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.