10 Best Forex Pairs to Trade for Prop Traders

- Ankit Gupta

- August 28, 2025

Introduction:

If you’ve ever opened a trading platform and felt overwhelmed by the endless list of currency pairs, you’re not alone. For a prop trader, knowing where the real liquidity is can save time, cut costs, and improve execution. While you can technically trade anything from the US Dollar to the South African Rand, the truth is that most traders stick to a small group of heavily traded pairs. Why? Because these markets offer tighter spreads, more predictable moves, and fewer nasty surprises. Let’s break it all down.Futures prop trading is one of the most exciting and high-stakes ways to engage in financial markets. Unlike retail trading, where you’re limited to your own capital, prop trading gives you access to firm capital, enabling you to trade larger positions with less personal risk. However, with this access comes responsibility, especially when it comes to futures trading rules.

In this article, we’re going to break down everything you need to know about how futures prop firms structure their rules, why those rules matter, and how they impact your daily trading. From understanding what drawdown means to the nuances of scaling models, we’ll cover it all, especially focusing on popular instruments like the ES and 6E futures.

If you’ve ever wondered why prop firms limit you from holding trades overnight or how they calculate your max loss, this comprehensive guide will provide all the answers and help you become a more disciplined, profitable trader in the process.

What are Currency Pairs?

A currency pair is exactly what it sounds like – two different currencies traded against each other. One is the base currency, which comes first in the pair. The other is the quote currency, which comes second.

If you see EUR/USD trading at 1.1694, it simply means one euro is worth 1.10 US dollars. Your profit or loss depends on how that rate changes.

For prop traders, understanding which currency is base and which is quote isn’t just academic – it directly affects your position sizing, pip value, and even your risk profile.

Different Types of Currency Pairs:

1. Major Pairs:

These include the US dollar on one side and are the most traded pairs globally. They’re highly liquid, meaning tighter spreads and faster fills – something every prop trader appreciates. For example, EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD. Many of the best forex pairs to trade are major pairs.

2. Minor Pairs:

Also called cross currency pairs, these don’t include the US dollar. Liquidity can still be decent, but spreads are generally wider than majors. For example, EUR/GBP, GBP/JPY, and AUD/JPY.

3. Exotic Pairs:

One major currency paired with a less traded one, like USD/TRY (US dollar/Turkish lira). They can move sharply, but trading costs are higher, and slippage can be a problem. You will rarely see these in the Best forex pairs to trade list, as due to their volatility and less liquidity, traders don’t use them much in their forex trading strategy.

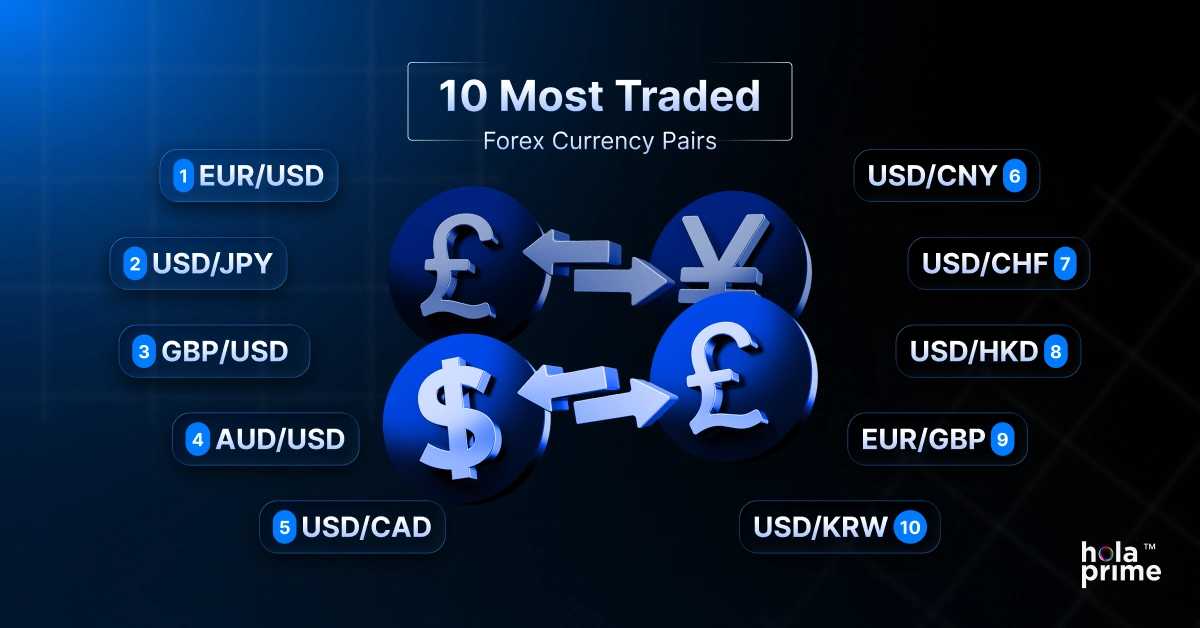

10 Best Forex Pairs to Trade:

Entering the forex market as a prop trader shows you at a very early stage that currency pairs are not all the same. Some trade with huge daily volumes, smaller spreads, and steady price shifts. While others trade with much more volatility. Here’s a closer look at the 10 Best forex pairs to trade according to the Bank of International Settlements (BIS) triennial survey, April 2019 and why they hold such importance.

Currency Pair | Symbol | Daily Trading Volume (Approx.) | Market Share |

Euro/US Dollar | EUR/USD | $1.1 trillion | 24.00% |

US Dollar/Japanese Yen | USD/JPY | $550 billion | 13.20% |

British Pound/US Dollar | GBP/USD | $360 billion | 9.60% |

Australian Dollar/US Dollar | AUD/USD | $240 billion | 5.40% |

US Dollar/Canadian Dollar | USD/CAD | $220 billion | 4.40% |

US Dollar/Chinese Yuan | USD/CNY | $200 billion | 4.00% |

US Dollar/Swiss Franc | USD/CHF | $180 billion | 3.60% |

US Dollar/Hong Kong Dollar | USD/HKD | $170 billion | 3.40% |

Euro/British Pound | EUR/GBP | $150 billion | 3.00% |

US Dollar/South Korean Won | USD/KRW | $120 billion | 2.40% |

1. Euro/US Dollar (EUR/USD)

The EUR/USD combination is the largest pair traded in the forex world, with $1.1 trillion traded a day, accounting for around 24% of the world market. Part of the reason for the popularity of this pair is the strength of both the US and Eurozone economies. The reason that this is one of the best forex pairs to trade is that the EUR/USD pair experiences large moves, mainly when either the Federal Reserve or European Central Bank raises or lowers interest rates. The pair also had dramatic moves during the 2008 financial meltdown and the Eurozone debt crisis from 2010-2012. Traders enjoy the liquidity of the EUR/USD pair, which allows orders to be filled at a faster rate while maintaining low costs.

2. US Dollar/Japanese Yen (USD/JPY)

The USD/JPY is another popular pair, which trades about $550 billion a day and takes up about 13.2% of the forex market share. The Yen is looked at as a safe-haven currency for many people because it strengthens amid global uncertainty. The Bank of Japan influences this currency pair by its monetary policy through low-interest rates. USD/JPY has also generated important moments, such as the dynamic movement following the 2011 Tōhoku earthquake and tsunami, when the yen spiked from repatriation flows.

3. British Pound/US Dollar (GBP/USD)

Traders often call GBP/USD “Cable,” and it trades $360 billion each day making up about 9.6% of the forex market. It tends to see larger intraday moves than EUR/USD, which draws in short-term traders. Between 2016 and 2020, Brexit talks showed how volatile this pair could be. Even now, it reacts to Bank of England policies, UK GDP numbers, and economic data from the US. If you’re after a liquid market with big price movements, “Cable” offers both.

4. Australian Dollar/US Dollar (AUD/USD)

Around $240 billion gets traded in this currency pair making up nearly 5.4% of the overall market. People often call it the “Aussie.” Commodity prices like gold and iron ore have a big impact on its value. Since Australia sells a lot of goods to China, changes in China’s economy affect this pair. Back in 2020 when the pandemic started, AUD/USD dropped to levels not seen in years but recovered fast as demand for commodities grew. For traders, it combines steady trends with enough movement to keep things interesting.

5. US Dollar/Canadian Dollar (USD/CAD)

Known as the “Loonie,” USD/CAD trades roughly $220 billion daily, accounting for 4.4% of the total market. Oil prices greatly impact this currency pair because Canada is one of the leading exporters of crude oil. When oil prices rise, CAD value becomes stronger, while oil price drops weaken CAD strength. Many traders follow this currency pair as a means to speculate on oil prices without commodity trading. Between 2014 and 2016, this currency pair saw significant swings due to the overall oil price crash. It is one of the Best forex pairs to trade if you follow the oil market and have knowledge about the price change patterns of USD/CAD.

6. US Dollar/Chinese Yuan (USD/CNY)

This currency pair handles $200 billion each day making up 4% of the forex market. The Yuan stands out since it isn’t free-floating. Instead, the People’s Bank of China (PBOC) issues a reference rate , which has an influence on its trading range. This pair’s shifts often mirror economic data from China, trade talks, or relations between the US and China. Traders looking at this pair focus more on keeping up with global economic trends than relying on technical charts.

7. US Dollar/Swiss Franc (USD/CHF)

USD/CHF sees trading of $180 billion every day taking up 3.6% of the forex market. Many traders view it as a safe-haven pair. The Swiss Franc often grows stronger when the world faces uncertainty. The Swiss National Bank steps in to manage unwanted increases in its value. One major example was in 2015 when they removed the EUR/CHF currency peg leading to chaos in the markets. For prop traders, this pair can serve as a dependable option to hedge riskier positions.

8. US Dollar and Hong Kong Dollar (USD/HKD)

The USD/HKD pair encounters an average of $170 billion in trading volume daily, representing 3.4% of global market share. The value is maintained by the Hong Kong Monetary Authority (HKMA), which pegs the value against the US dollar. The peg makes price movements less severe (and therefore less volatile) than other currency pairs.

9. Euro/British Pound (EUR/GBP)

The EUR/GBP currency pair encounters an average of $150 billion in trading volume daily, representing 3% of total volume. The EUR/GBP compares the two economies of the Eurozone and the UK’s economy against each other, and the Brexit period created years of extremely volatile price swings. To this day, trade deals and economic reports, along with decisions from the both ECB and the BoE influence price swings. Many traders use this pair for hedging when trading other EUR/USD, or GBP/USD pairs directly.

10. US Dollar/South Korean Won (USD/KRW)

Traders exchange USD/KRW at a daily volume of $120 billion holding a 2.4% share of the forex market. Changes in global risk appetite and South Korea’s export-heavy economy influence this pair. Since Korea leads in tech exports, shifts in semiconductor demand shape the Won. Interest rate decisions by the Bank of Korea also have a significant role for this currency. Though less liquid than major pairs, traders who know how the Asian markets work still find it appealing.

Things That Shape the Forex Market:

The forex market doesn’t move aimlessly. It reacts to global events, economic reports, and how traders think and behave. As a prop trader, you need to grasp these aspects. This knowledge is what keeps you from making expensive errors and helps you trade.

1. Interest Rates and Central Bank Policy

Key players like the Federal Reserve, ECB, BoJ, and BoE have the most sway over currency movements. When interest rates rise, currencies often grow stronger because foreign investors see them as more attractive. On the other hand, cutting rates typically causes currencies to lose strength. Monetary policy updates and central bank press talks can cause market shifts almost.

2. Economic Data Releases

Figures like GDP growth, unemployment rates, inflation stats, and retail sales play a role in shaping currency value. A strong US jobs report, as an example often lifts the USD. Traders watch out for these reports because they tend to spark quick short-term price swings.

3. Geopolitical Events

Factors like wars, elections, unstable politics, and trade disputes influence currencies too. Many turned to safer currencies such as the USD, CHF, and JPY when the Russia-Ukraine war broke out. On the other hand, political chaos can ruin a currency.

4. Commodity Prices

Commodity currencies, such as AUD, CAD, and NZD rely on commodities such as oil and gold. If oil prices increase, CAD rises. If gold prices fall, AUD usually suffers.

5. Market Sentiment and Risk Appetite

Sometimes, sentiment and market mood will drive price movement more than solid data. When the market is in an optimistic mindset, traders prefer to hold currencies with higher yields. When the mood is pessimistic, they will look for safer assets. Monitoring sentiment can provide an indication of price changes in the short term.

6. Global Trade Flows

Countries that export more than they import see their currencies grow stronger over time. Trade balance numbers often shape longer-lasting trends in nations dependent on exports.

Trading forex boils down to how these factors fit together. Prop traders who succeed tend to figure out the bigger economic picture and approach it with discipline.

Conclusion:

This detailed blog is about the 10 best forex currency pairs, which are the most traded in the forex market. There are different factors that you need to consider when you choose a currency pair to trade. One of the most important factors is your knowledge about the currencies involved and the factors that affect them.

Now that you have knowledge about the Best forex pairs to trade, it is a perfect time to start your prop trading challenge with Hola Prime, where you get payouts in 1 hour.

FAQs: Best forex pairs to trade

1. Which is the best forex pair to trade?

It depends on your trading strategy and how much risk you are willing to take. There are some pairs that are very volatile and can be good options for day traders or scalpers; also, there are some pairs that are less volatile and can be better options for swing traders.

2. Which currency pairs are most volatile?

The most volatile currency pairs are NZD/JPY, EUR/GBP, CAD/JPY, and GBP/AUD. These pairs can move from 50 to over 100 pips a day.

3. What is the most predictable forex pair?

Well, no currency pair is 100% predictable; however, based on the historical data, EUR/USD is a stable currency. It is so because of its trading volume and high liquidity.

4. What is the safest forex pair?

No financial market is without risks; however, currency pairs like EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, GBP/JPY, EUR/JPY, and USD/CAD are considered less volatile and safer than others.

5. What affects the prices of currency pairs?

Different factors affect the currency pairs’ price. Most common factors are, policy decisions, announcements by central banks, geopolitical events, and more.

Disclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.