If you’ve been curious about what it really takes to get funded by a futures prop firm, you’re in the right place. Let’s get into it.

What is a Prop Firm Challenge?

Before you jump into strategy, it helps to understand what you’re signing up for.

A prop firm challenge is essentially a test - one where you trade using simulated funds to prove you can manage risk and make profits. If you pass, you get access to a simulated funded account where your skills can turn into actual payouts. These challenges typically come with a profit target, drawdown limits, and a few rules on how you can trade.

It’s a win-win when done right. You pay a small fee, generally monthly or one-time, trade within certain boundaries, and if you hit the targets, you trade on your simulated funded account.

But while it sounds simple, most traders don’t pass on the first go, not because they’re bad traders, but because they overlook a few key things. Let’s break those down.

Important Things to Consider During Futures Challenge:

1. Profit Target:

This is the number every trader keeps their eyes on. But here’s the trick—trying to hit it too fast is where most people mess up. You don’t need to make 10% in a day. Stretch your plan over the challenge period and take high-quality setups. Focus on being consistent, not aggressive.

2. Drawdowns:

Most challenges have two kinds: daily drawdown and overall drawdown. If your account drops below either, you’re out. You’d be surprised how many traders forget this and end up overleveraging. Keep these limits in mind before every trade. When you trade with Hola Prime Futures, there is no daily drawdown limit, which can help you in implementing your strategy without worrying about the daily drawdown.

3. Firm’s Rules:

Different firms have different rules, hence, you must read the rules of the prop firm very carefully. Things like trading during news events, holding trades overnight, or using any specific restricted strategy can lead to disqualification if not followed. Don’t assume anything. Read the rules once, then read them again.

4. Familiarity with Platform:

We know this might sound basic, but it matters. If you are using a new platform, you should take a few hours to get comfortable with the interface, order placement, charting tools, and risk settings. You don’t want to lose a trade just because you clicked the wrong button.

5. Trading Days:

Some challenges require a minimum number of active trading days. That means you can’t just hit your target in one day and stop trading. Plan for that. Spread your trades across days, even if you hit early wins.

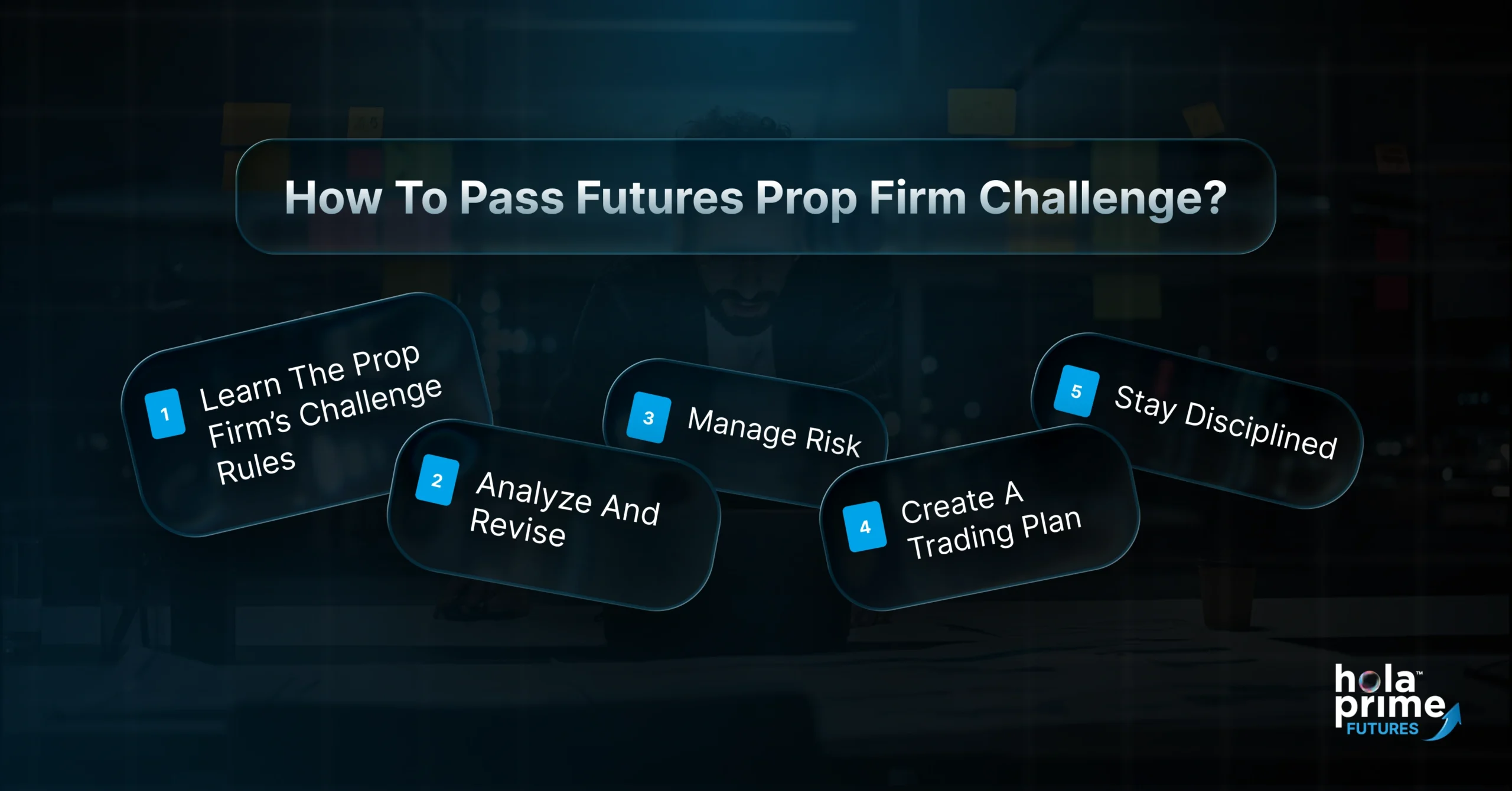

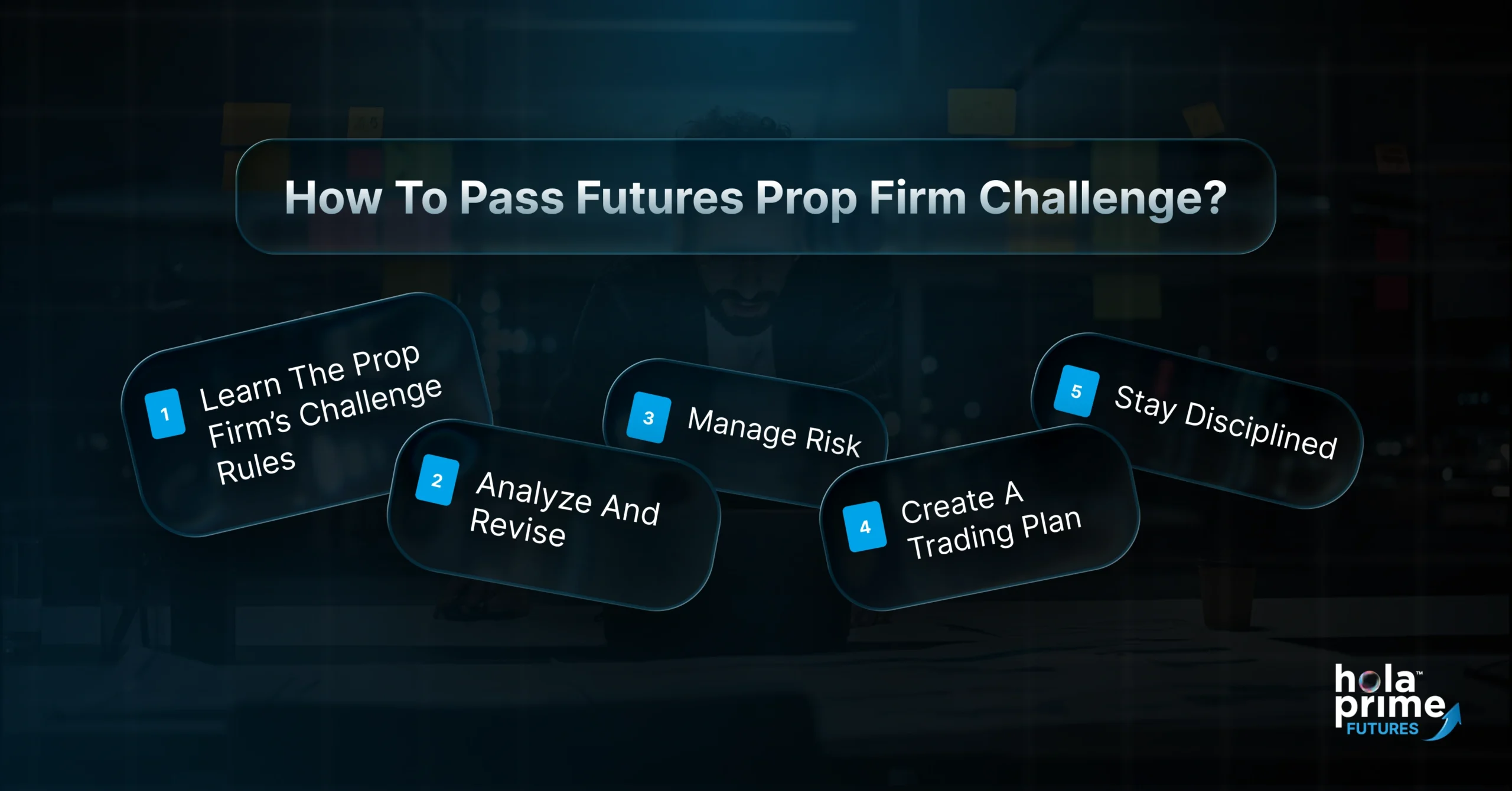

How to Pass Futures Prop Firm Challenge?

Now that you know what to expect, let’s focus on what you can do to actually pass the challenge.

1. Learn the Prop Firm’s Challenge Rules:

We’re repeating this for a reason. Go through the challenge rules before placing your first trade. Make a note of key numbers - profit target, max drawdown, allowed instruments, and payout model. Choose firms that offer this level of clarity, so you’re not trading in the dark.

2. Create a Trading Plan:

Walking into a challenge without a plan is like driving with your eyes closed. Decide what you’ll trade, when you’ll trade, how much risk per trade you’ll take, and when you’ll walk away for the day.

Include details like:

- Max trades per day

- Trade time windows (avoid overtrading late in the day)

- Your go-to setups and how you’ll spot them

Your plan is your anchor. Stick to it unless there’s a strong reason not to.

3. Manage Risk:

This is where traders make or break the challenge. Just because you’re trading simulated capital doesn’t mean it’s time to gamble. Remember—you still want to get funded.

A good strategy is not to risk more than 1% of your account on any single trade. And if you hit a losing streak, pause and re-evaluate. Also, avoid revenge trading. One bad trade doesn’t need to turn into five.

4. Stay Disciplined:

You know what to do - now do it. The hardest part of any challenge is staying disciplined when the markets tempt you to act otherwise.

Here are a few things that help:

- Set alerts instead of staring at the screen all day.

- Walk away after hitting your daily goal or loss limit.

- Keep a log of your trades and emotions each day.

A trader without discipline cannot sustain in the market, no matter how effective his trading strategies are.

5. Analyze and Revise:

At the end of each day (win or lose), go over your trades. Ask yourself:

- Did I follow my rules?

- What worked and what didn’t?

- Were there emotional decisions involved?

This will help you identify patterns and understand what is working well and what is not. If you catch yourself making the same mistake two days in a row, you should analyze it and revise it.

And if you don’t pass on your first try, that’s okay. Take what you learned and implement it the next time. Most traders who get funded have failed at least once before they figured it out.

Conclusion

Passing a futures prop firm challenge isn’t about flashy strategies or risky bets. It’s about understanding the rules, managing risk, staying level-headed, and treating it like a real trading account - because once you pass, that’s exactly what it becomes. If you’re serious about becoming a funded trader, the challenge is your gateway. But treat it like a test of patience and precision, not a race.

FAQs: How to Pass Futures Prop Firm Challenge

1. Do I need to trade every day during the futures prop firm challenge?

Not necessarily. Most firms just require you to trade a minimum number of days. You can skip days when there’s no good setup or when you’re not mentally in the zone.

2. How important is the profit target in futures prop firm challenges?

It’s one of the key targets that you have to meet. But hitting the target too quickly by risking too much can backfire. You should focus on creating a strategy where you plan to hit profit targets over a period of time, while keeping the risk parameters in consideration.

3. What if I hit the maximum drawdown limit?

If you hit the maximum drawdown limit, your challenge would be automatically considered as failed.

4. How much should you risk per trade?

As a rule of thumb, you should not risk more than 1% of your account balance.

5. What if I fail the futures prop firm challenge?

You can always start again with a new challenge. Moreover, the next time you will be trading with more experience.

Become an Hola Prime Trader

Start trading within minutes!

Start Now

Join Discord

Disclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.